DOVER, Del.- The Delaware Court of Chancery has upheld House Bill 242, a law that changes how property taxes are calculated following the state’s long-delayed reassessments.

Vice Chancellor Will issued the opinion Thursday, affirming the legality of the law passed during the August 12 special session. The legislation aimed to ease the impact of property value shifts on homeowners, especially in New Castle County.

Top Democratic leaders — including Senate President Pro Tempore Dave Sokola, House Speaker Melissa Minor-Brown, Senate Majority Leader Bryan Townsend, House Majority Leader Kerri Evelyn Harris, Senate Majority Whip Elizabeth “Tizzy” Lockman, and House Majority Whip Ed Osienski — released a joint statement praising the decision.

“We thank Vice Chancellor Will for her thorough examination of House Bill 242 and thoughtful opinion that upholds all the terms of this legislation,” the statement said. “Starting immediately, New Castle County will be able to reissue new property tax bills with reduced school tax rates for most residents. This means taxpayers will finally have clarity on their tax bills due November 30.”

Lawmakers also said the bipartisan special committee investigating Delaware’s reassessment process will resume its work soon, although the next meeting — originally scheduled for Tuesday, Nov. 4 — has been canceled due to the ongoing litigation in New Castle County. No new date has been set.

Meanwhile, some Republican lawmakers are calling for the entire reassessment to be done over.

State Reps. Kevin Hensley (R-Townsend, Odessa, Port Penn) and Mike Smith (R-Pike Creek Valley) say the process that determined current property values was “badly flawed.” Both serve on the House Special Property Reassessment Committee.

“Regardless of whether we have a one-tier or two-tier system of tax rates is kind of beside the point,” Hensley said. “The property valuations on which those taxes are based are badly flawed.”

Smith agreed, saying many New Castle County residents no longer trust the outcome. “Some properties vanished during the process or had major components left unassessed,” he said. “Leaving the owners of commercial properties to pay less than their fair share means homeowners will collectively pay more.”

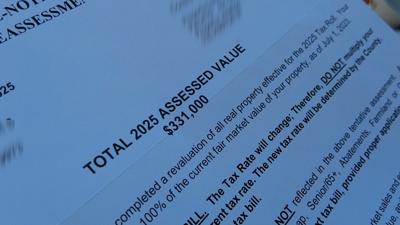

The statewide 2024 reassessment followed a 2020 lawsuit that argued the lack of contemporary valuations had created disparities in public education funding.