MILTON, Del. - They say that home is where the heart is, but Dan and Carol Perrotta of Milton have no idea where their fourth bathroom is. That's because it doesn't really exist, though their property reassessment notice says it does.

The Perrottas, who moved from Connecticut to Milton in 2015, are just one of many households concerned about their recent data mailers from Tyler Technologies, the company hired by Sussex County in 2021 to complete reassessments for about 150,000 properties in the county. Dan and Carol invited CoastTV into their home to note a handful of differences between the data mailer they received on July 19 and what they experience every day at home.

The Perrottas' home does not have a fireplace, though their data mailer says it does. It also says they have a half bathroom, which they don't, and a full basement, which CoastTV saw was really a crawlspace just 45 inches tall. Other discrepancies include marking the home as nearly 300 square feet larger than Dan estimates based on his builder-provided floor plan and identifying it as having one and a half stories, which Dan says should be two.

"I put this on Nextdoor because I thought this was unique to my community... I didn't realize other communities were also receiving the same kind of letter and I got maybe 30 to 35 replies. People from other communities are having the same issues," Dan told us. "This is very concerning because I know we pay our taxes based on what this assessment says, and we don't have those things. If they charge taxes based on that, then we're paying too much tax."

"I have no problem paying the right amount; I know we need it for services like police and fire and schools and such, but I want to pay my fair share, and that's somebody else's fair share," Dan continued.

Differences disputed

Dan and Carol Perrotta were one pair of many property owners on social media expressing concerns in recent weeks about differences between their reassessment data mailer and what they experience in their home every day.

Property owners throughout Sussex County and across Delaware are in the midst of a major property reassessment project. Mary Noldy, Mid-Atlantic regional manager with Tyler Technologies and project supervisor for the Sussex County reassessment, broke down the entire process.

Tyler Technologies and its appraisal division have been in business since 1938 and complete reassessments across the country. Tyler data collectors began visiting every single property in Sussex County beginning in October 2021 to photograph them and note property characteristics and improvements, or changes. The process began on paper and switched over to digital tablets about four months in, which then directly uploaded the information to the county's database. Data collectors did not go into any homes, though they would speak with homeowners if they were available at the time of their visit to ask questions about the home's interior. Questions were along the lines of what type of heating system was installed, if the basement was finished, how many bedrooms and bathrooms it had and if they could take some measurements.

If nobody was home, data collectors would estimate based on similar properties nearby. There were some instances when collectors couldn't even get close, however.

"This is a very minimal part of what we do or what we face and are experiencing, but there are times they face a lot of challenges in the field," Noldy said. "Things like dogs chasing them or homeowners saying, 'we don't want you collecting on this entire street.' Some homeowners associations have prevented us from being able to do that complete door-to-door job."

In instances like these, Noldy said they use other resources like aerial imagery, county and public records and MLS, or multiple listing service, which is a platform used in real estate that compiles all listings available for sale in a certain area.

"We do our best to try to collect accurate information, but there will still be that small margin of error for properties that we couldn't lay eyes on in person for one reason or another, or the collector simply made a mistake," Noldy said.

At the time of our Aug. 2 interview, Noldy said inaccurate information is a small amount of the overall reassessment file. So far, 89 percent of mailers have been processed and are in the county system already. Tyler Technologies has a return rate of data mailers with corrections from owners at about 22 percent, with many regarding interior data that collectors can't see from an outdoors inspection, like the number of bathrooms. Noldy estimates that people with concerns like the Perrottas make up between 1 to 2 percent of that number.

"The other piece to that is, sometimes there's also a perception issue," Noldy explained. She gave an example of a bilevel home, which is how Tyler Technologies could list a home with one story and a full finished basement, though a homeowner may return his data mailer to say this home is two stories instead. The number of floors was a point of confusion for the Perrottas when it came to their data mailer, as well as interior differences Noldy predicted.

"I was very surprised to see the differences, especially since the house is so new. It would be different if we had the house and made changes that gave us a better value, maybe we added a bathroom or put in a fireplace, but since nothing has changed because the house is so new, we were very surprised to see these things listed," Dan Perrotta said.

Carol Perrotta agreed that they were surprised. "We don't know anything about what they're doing. We don't know where they got the information from, so we don't know if it's their fault or if it couldn't be their fault because they're only telling us what they were told."

Why is this so confusing? Well, this process was last completed 50 years ago in 1974. Until a 2018 lawsuit regarding education funding in the state, Delaware had been a base year state. This means properties were assessed based on their value in a given year, and for Delaware, that year was 1974. They haven't been updated until now, which is one of two reasons this process has been confusing for people like the Perrottas:

- Delaware homeowners haven't gone through a reassessment in 50 years, meaning most haven't gone through a reassessment ever.

- An influx of people moving to Delaware from other states don't know what to expect here.

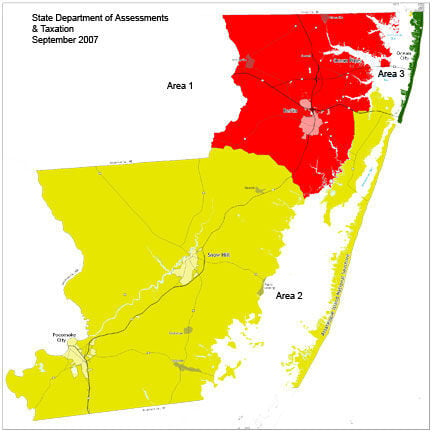

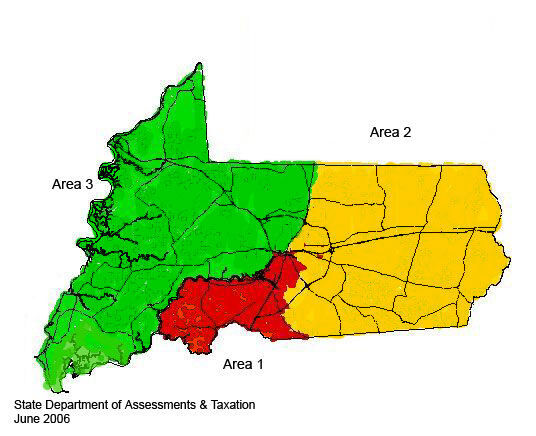

Property reassessments are completed in different areas around the country at different frequencies depending on state and local laws. In Maryland, properties are divided into three groups and each is reassessed on a three-year cycle. New Jersey, which has the highest property taxes in the country, also reassesses on a cyclical basis.

Maryland property assessments

More than two million properties in Maryland are split into three groups, each appraised once every three years. According to the Maryland Department of Assessments and Taxation, the overall state increase in property value for this group was 20.6 percent over the period of 2020 to 2022, reflecting the largest property value increase in several years and a rise in values since the onset of the COVID-19 pandemic.

Delaware will now begin reassessing every five years. This change came after a 2021 settlement in a years-long legal debate over real estate assessments used by Delaware's counties to calculate annual tax bills. In 2018, a lawsuit regarding education funding was brought against the State of Delaware and the three counties in the Court of Chancery, which alleged that the outdated property value system was harming Delaware students and school systems. According to Sussex County, approximately 10 percent of the typical residential tax bill in Sussex County is for county property taxes, while the remaining 90 percent is for local schools.

By not changing the base year, local school systems have been receiving funding the way they were 50 years ago, which likely contributed to some of the confusion surrounding the two recent failed Cape Henlopen School District referendums. Many were shocked that a house estimated at $475,000 on Zillow had an assessed value of $52,600 in Sussex County property records, meaning tax increases for the referendum were based on $52,600 instead of $475,000, and this is part of why. During the time of this spring's referendums, the average value of a home in the Cape Henlopen School District, which includes homes in Milton, Lewes and Rehoboth Beach, was $28,006 according to the district.

Even after reassessment, districts will be limited in additional yield from property tax increases due to state code. Both the county and school districts are capped by law on how much additional revenue can be generated from reassessment. Delaware code states that the county cannot yield property tax revenues greater than 15 percent of the year before the reassessment occurred. School districts are capped to a 10 percent revenue increase.

"A large part of what we do in these base year states, where people may not have ever gone through a reassessment before, is educate them on the process," Noldy said. "We want to be transparent. I think it's very important that people understand they are part of the process and they have the right to be an advocate for themselves throughout all of this."

Noldy laid out five ways for homeowners to get involved, some of which have passed while others are ongoing.

- Attend public meetings, which were held early on in the process and along the way, and read up on the situation on the county and Tyler Technologies websites.

- Talk to data collectors while they're surveying.

- Read data mailers carefully and send back any needed corrections.

- Participate in informal property reviews to ask questions and get answers.

- After the process is complete, homeowners have the ability to appeal to the county's formal assessment appeal board in spring 2025.

"What's important to know is they can call us at any time and we're happy to explain to them what our processes are and also to know that, if we're treating one bilevel as a one story home over a full furnished basement, we're treating all bilevels the same way," Noldy said, "So the homeowner wouldn't be penalized or treated differently from houses that are similar."

More information about the Sussex County property reassessment project is available online at empower.tylertech.com. Those who would like to speak with a Tyler representative to ask questions about the data collected for their properties can call 302-854-5274 or email SussexCountyDE@TylerTech.com.

About 95 percent of data mailers have been sent out to property owners as of early August, according to Noldy, though it's important to note that they will not receive a mailer for vacant land or commercial property. Those who haven't received a mailer or may have thrown it away unknowingly should call or email Tyler Technologies for another copy to be mailed.

Noldy recommends homeowners review the information listed and save the mailer for their records. If all is correct, there's no need to do anything. If there are discrepancies, property owners should make corrections directly on the mailer and send it back. In instances like the number of bedrooms, Tyler Technologies can make a change more easily, but if home sketches or square footage is incorrect or there are larger issues, a representative will need to go back to revisit the property.

Tyler representatives have begun to start placing values on properties in their system, a process that is expected to continue for a few more months. Notices of tentative value will be sent to property owners mid-winter, which will be the first time they'll be able to see their property's estimated value.

Receiving the notice of tentative value is another opportunity to ask questions, Noldy said, with informal property reviews expected to be available from late November through January. Property owners can make appointments to meet with Tyler representatives to review data on file and discuss the value.

Final values will then be prepared and turned over to Sussex County government in early 2025. If there are no changes or appeals, those values will stand and be in place for the 2025 tax year.